When you consider your monetary future, do you're feeling self-confident or overwhelmed? Right money planning starts off with a practical evaluation of your respective latest fiscal problem. You'll have to calculate your net worthy of to have a crystal clear starting point. From there, environment Wise goals can guide your brief and long-time period fiscal techniques. But how accurately can these plans change your money well being, and what measures in the event you acquire future to ensure you're not just surviving, but truly thriving economically? Let us take a look at how a detailed, actionable approach could change the class of one's monetary life.

Knowing your monetary position could be the cornerstone of productive fiscal arranging. Figuring out in which you stand monetarily will involve a clear idea of your fiscal health and Web worthy of. What this means is You'll have to compile and assess detailed knowledge regarding your belongings and liabilities.

Your Web really worth is basically the distinction between what you personal (your assets) and That which you owe (your liabilities). Belongings include funds, investments, assets, and the rest of price you have. Liabilities, on the other hand, encompass your debts, which include financial loans, mortgages, and credit card balances.

To properly evaluate your financial overall health, it's essential to calculate your Web really worth by subtracting your whole liabilities from the whole property. A beneficial Internet well worth indicates that you've got more property than liabilities, suggesting a healthier economical standing. Conversely, a unfavorable Web value exhibits that the liabilities outweigh your belongings, signaling a need for immediate awareness and adjustment with your monetary system.

It can be crucial to consistently update this calculation to track your economic progress after a while. Further, comprehension your economical well being is not almost understanding your present-day placement but examining the trends as part of your economic journey.

You'll want to look at changes within your asset values and legal responsibility balances, evaluate how They are influencing your net well worth, and establish any opportunity threats or alternatives for enhancement.

Once you've assessed your financial position, it is important to established clever fiscal targets to manual your future endeavors. To begin, let us differentiate amongst your brief-time period goals plus your very long-time period visions.

Brief-expression aims usually span a duration of up to 3 decades and might contain saving for the deposit on an automobile, building an emergency fund, or shelling out off superior-curiosity debts. These objectives tend to be tactical and highly centered, demanding Regular review and adjustment. Conversely, your prolonged-term visions prolong beyond 3 many years and will encompass saving for retirement, funding a child's training, or acquiring a house. These demand a strategic strategy, demanding tolerance and persistent effort and hard work.

When placing these ambitions, you'll need to take into consideration a variety of elements such as likely profits expansion, inflation charges, and changes as part of your fiscal circumstances.

To set these aims properly, you ought to make them particular, measurable, achievable, related, and time-certain (Sensible). For instance, rather than vaguely aiming to "help you save more cash," specify "I will save $300 monthly toward a $ten,800 unexpected emergency fund in the following three years." This clarity improves your emphasis as well as the chance of accomplishing your purpose.

Furthermore, combine your ambitions with your personal values and Life style Choices to ensure they remain motivating and aligned using your broader lifetime plans.

Regularly revisiting and altering these ambitions is vital as your money predicament and priorities evolve.

Using your monetary plans Obviously described, It really is vital to produce a funds that paves the way for achievement. What this means is not only tracking your cash flow and expenses but additionally building strategic conclusions that align along with your long-time period aims. A properly-crafted price range functions being a roadmap, guiding you toward monetary stability and advancement.

First, evaluate your profits resources and categorize your expenditures. You'll have to generally be meticulous in recording wherever just about every dollar is allotted. This process is crucial in identifying parts where you can Minimize back, thus increasing your savings amount. Recall, even modest adjustments in the shelling out behavior can significantly effects your economic future.

Following, prioritize the institution of the emergency fund. This fund is a big buffer against unforeseen fiscal shocks, like clinical emergencies or unexpected work reduction. Ideally, you ought to intention to save a minimum of three to 6 months' truly worth of dwelling bills. This proactive action don't just secures your monetary base but additionally provides you with relief, allowing you to definitely focus on other monetary objectives without the continuous be concerned of prospective emergencies. Additionally, your Life-style alternatives Enjoy a substantial part in productive budgeting. Go for sustainable and monetarily reasonable behaviors. By way of example, eating out considerably less frequently, deciding upon a lot more affordable amusement options, and employing general public transportation can all be parts of a funds-helpful lifestyle. Every alternative should assistance your overarching fiscal aims.

Taking care of your personal debt correctly is important for maintaining money stability and attaining your prolonged-phrase ambitions. In the area of debt administration, it's essential to be aware of and hire methods like debt consolidation and credit score counseling. These resources can drastically streamline your fiscal obligations and direct you in direction of a more secure economic potential.

Financial debt consolidation entails combining numerous debts into a single loan with a decrease fascination level. This method simplifies your payments and can reduce the quantity you pay in fascination, rendering it much easier to manage your finances. You will find that by consolidating, you could concentrate on only one repayment approach, usually with extra favorable terms, which can expedite your journey out of personal debt.

Credit history counseling, Conversely, presents Experienced steerage on controlling your debts. Engaging which has a credit rating counselor can assist you realize the nuances of your economical predicament. They are able to give customized advice on budgeting, taking care of your investing, and negotiating with creditors to most likely reduced fascination rates or generate possible repayment plans.

It's an educational resource that also holds you accountable, which can be priceless in protecting economic discipline.

It's also a good idea to on a regular basis evaluation your credit card debt management approach. Financial situations alter, and remaining proactive about modifying your approach can help you save from opportunity fiscal pressure. Don't forget, the objective is to don't just take care of your debt but to take action in a method that supports your Total monetary health and fitness.

You could possibly discover that shifting from taking care of debt to focusing on financial investment alternatives opens up a completely new spectrum of financial chances. When you navigate this terrain, comprehending the assorted landscape of financial investment choices is important to maximizing your money expansion.

First of all, the stock marketplace delivers dynamic opportunity for cash appreciation. By buying shares of public organizations, you are basically buying a stake in their long term earnings and development. Nonetheless, the stock marketplace may be volatile, demanding a balanced method and complete investigate.

Real estate property financial commitment stands for a tangible asset that generally appreciates with time. No matter whether you're shopping for Homes to hire out or to market in a earnings, housing can provide equally continual profits and extended-time period money gains. It calls for sizeable cash upfront but could be a reputable hedge towards inflation.

Mutual money and index resources present a means to diversify your investments throughout many assets. Mutual funds are managed by experts who allocate your money throughout various securities, aiming to strike a equilibrium in between risk and return.

Index funds, Alternatively, passively monitor a particular index similar to the S&P five hundred, presenting a lessen-cost entry into the industry with Traditionally steady returns.

Bonds supply a much more conservative expenditure avenue, giving typical revenue by means of interest payments. They are normally safer than stocks but give lessen return probable.

Emerging expense lessons like copyright and peer-to-peer lending current fashionable possibilities. copyright, while hugely risky, has demonstrated sizeable development probable.

Peer-to-peer lending permits you to lend income on to individuals or organizations, earning curiosity because they repay their loans.

And finally, commodities like gold or oil present solutions to diversify and hedge towards marketplace volatility and economic shifts, although they come with their very own list of risks and complexities.

Checking out investment options provides a sturdy foundation for developing your retirement financial savings. When you examine the various avenues for accumulating prosperity, It really is vital to align your possibilities using your expected retirement age and ideal Life-style.

You will discover that a effectively-structured portfolio not only grows your property but will also mitigates pitfalls common sense retirement planning as your retirement age ways.

You have to understand the importance of diversification. Spreading your investments throughout diverse asset classes—stocks, bonds, real estate, And perhaps precious metals—will help regulate hazard and smoothens out returns after some time.

It is also imperative that you reassess your chance tolerance as you age; commonly, a shift in direction of much more conservative investments is prudent while you close to retirement.

Tax concerns Engage in a essential part in maximizing your retirement price savings. Take full advantage of tax-deferred accounts like 401(k)s and IRAs, which permit your investments to develop without the drag of yearly taxes, and consider Roth options for tax-cost-free withdrawals in retirement.

Remember, though, that certain regulations govern when and tips on how to obtain these resources with out penalties.

Yet another major ingredient is planning for the sudden. Insurance plan products and solutions, including annuities and lifetime insurance plan, can offer further protection, making sure that you won't outlive your discounts or go away your dependents economically strained.

Lastly, It truly is important to critique and change your retirement approach periodically, Particularly right after main existence functions or important market place improvements.

This adaptive solution not only safeguards your discounts but will also boosts your money resilience, ensuring you are perfectly-geared up for a cushty retirement.

Effective monetary organizing hinges on your own power to evaluate your present-day monetary standing, established sensible objectives, and diligently take care of your budget and personal debt. Exploring assorted financial investment solutions and organizing for retirement are vital ways toward securing your fiscal future. Consistently revisiting and adjusting your financial strategy ensures it stays aligned together with your evolving economical demands and plans. Embrace these methods to navigate your economical journey with self confidence and precision.

Kelly Le Brock Then & Now!

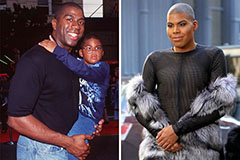

Kelly Le Brock Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!