When you concentrate on your fiscal foreseeable future, do you really feel self-assured or overwhelmed? Appropriate money preparing starts off with a realistic assessment of your present-day fiscal predicament. You'll need to work out your Web worthy of to have a obvious place to begin. From there, setting Sensible ambitions can guideline your quick and long-phrase money tactics. But how precisely can these objectives rework your monetary wellbeing, and what ways in case you consider up coming to guarantee you are not just surviving, but truly flourishing economically? Let's investigate how a detailed, actionable system could alter the system of the fiscal life.

Understanding your economic status will be the cornerstone of helpful financial planning. Recognizing where you stand financially includes a transparent comprehension of your economic wellness and Internet value. This suggests You will need to compile and assess comprehensive information regarding your assets and liabilities.

Your Web well worth is essentially the distinction between Everything you personal (your belongings) and Everything you owe (your liabilities). Property incorporate money, investments, residence, and anything else of worth you possess. Liabilities, on the other hand, encompass all of your debts, for instance financial loans, mortgages, and charge card balances.

To correctly assess your financial health, you must determine your Web truly worth by subtracting your whole liabilities from a full belongings. A positive Web really worth signifies you have far more assets than liabilities, suggesting a healthier economic position. Conversely, a unfavorable Internet truly worth displays that the liabilities outweigh your property, signaling a need for instant attention and adjustment within your economic system.

It really is critical to often update this calculation to trace your monetary progress with time. More, comprehension your economical health and fitness isn't really almost knowing your present-day position but examining the developments inside your economical journey.

You'll want to study changes in the asset values and legal responsibility balances, evaluate how They are influencing your Web worthy of, and recognize any likely pitfalls or prospects for improvement.

When you've assessed your monetary status, it's important to established intelligent money targets to information your future endeavors. To start, let us differentiate in between your shorter-term goals plus your prolonged-phrase visions.

Limited-time period goals ordinarily span a duration of up to a few several years and could involve saving for the deposit on a car, building an emergency fund, or spending off higher-interest debts. These objectives tend to be tactical and remarkably targeted, demanding frequent assessment and adjustment. On the flip side, your lengthy-time period visions prolong further than 3 several years and will encompass conserving for retirement, funding a Kid's schooling, or getting a home. These need a strategic tactic, demanding endurance and persistent effort and hard work.

When setting these ambitions, you'll need to take into account a variety of things such as opportunity revenue growth, inflation fees, and modifications in the fiscal instances.

To set these plans correctly, you should make them certain, measurable, achievable, suitable, and time-certain (SMART). As an illustration, instead of vaguely aiming to "help you save more money," specify "I'll save $three hundred month to month in direction of a $ten,800 crisis fund in the following 3 a long time." This clarity enhances your emphasis plus the chance of reaching your aim.

Moreover, combine your aims with your individual values and Way of life Choices to ensure they remain motivating and aligned with the broader life designs.

Regularly revisiting and altering these ambitions is vital as your financial situation and priorities evolve.

Along with your fiscal targets clearly described, it's important to build a price range that paves the way for achievement. This implies not just monitoring your cash flow and expenses but will also creating strategic decisions that align together with your extended-expression aims. A perfectly-crafted budget acts like a roadmap, guiding you toward money steadiness and development.

Very first, assess your revenue sources and categorize your expenses. You'll have to be meticulous in recording in which each individual dollar is allocated. This process is crucial in determining parts where you can Lower again, thereby growing your financial savings price. Keep in mind, even modest changes with your spending routines can enormously effect your money long run.

Future, prioritize the establishment of the unexpected emergency fund. This fund is a big buffer from unexpected monetary shocks, such as health care emergencies or sudden occupation loss. Ideally, you ought to purpose to save at least a few to six months' worthy of of dwelling fees. This proactive step not only secures your monetary foundation but will also gives you relief, enabling you to center on other economic targets with no frequent be concerned of probable emergencies. In addition, your Way of living alternatives Participate in a considerable role in profitable budgeting. Choose sustainable and financially practical behaviors. By way of example, dining out fewer commonly, selecting additional inexpensive amusement choices, and working with general public transportation can all be portions of a price range-friendly Life-style. Each and every alternative ought to help your overarching economic objectives.

Controlling your debt efficiently is important for retaining monetary balance and attaining your lengthy-time period goals. In the region of credit card debt management, It can be important to understand and hire tactics like credit card debt consolidation example retirement plan and credit counseling. These applications can drastically streamline your economic obligations and guide you towards a safer economic long run.

Personal debt consolidation involves combining a number of debts into an individual personal loan that has a reduce desire level. This system simplifies your payments and may decrease the amount you pay out in fascination, making it less complicated to deal with your finances. You will find that by consolidating, you may target an individual repayment plan, often with additional favorable terms, which might expedite your journey away from debt.

Credit score counseling, Alternatively, provides Expert advice on handling your debts. Participating which has a credit counselor will help you recognize the nuances of the money scenario. They are able to supply personalized guidance on budgeting, controlling your expending, and negotiating with creditors to probably reduced fascination rates or generate possible repayment programs.

It truly is an educational source that also retains you accountable, which can be invaluable in retaining economical self-control.

It is also smart to regularly overview your credit card debt administration system. Financial predicaments adjust, and staying proactive about adjusting your prepare could help you save from likely financial pressure. Bear in mind, the aim would be to not more info only regulate your debt but to do so in a method that supports your Total financial health.

You could see that shifting from controlling debt to focusing on financial commitment solutions opens up a new spectrum of financial prospects. When you navigate this terrain, comprehension the assorted landscape of expense options is important to maximizing your financial progress.

To start with, the stock market place presents dynamic opportunity for funds appreciation. By obtaining shares of general public businesses, you are basically purchasing a stake within their foreseeable future earnings and progress. Nevertheless, the inventory current market might be unstable, necessitating a well balanced tactic and extensive study.

Housing expense stands being a tangible asset that usually appreciates with time. No matter if you're acquiring Houses to rent out or to sell at a profit, property can offer equally regular money and extensive-expression funds gains. It demands major funds upfront but could be a reputable hedge from inflation.

Mutual cash and index funds give a way to diversify your investments across a lot of belongings. Mutual money are managed by industry experts who allocate your cash throughout various securities, aiming to strike a stability concerning hazard and return.

Index resources, on the other hand, passively monitor a particular index similar to the S&P five hundred, offering a decrease-Value entry into the market with historically secure returns.

Bonds offer a a lot more conservative investment avenue, offering regular cash flow by means of interest payments. They're usually safer than stocks but supply reduce return possible.

Rising investment decision lessons such as copyright and peer-to-peer lending current modern day opportunities. copyright, even though really volatile, has revealed significant development possible.

Peer-to-peer lending allows you to lend dollars directly to individuals or enterprises, earning curiosity because they repay their financial loans.

Last of all, commodities like gold or oil provide options to diversify and hedge from marketplace volatility and economic shifts, even though they feature their own individual list of dangers and complexities.

Discovering investment decision selections supplies a sturdy Basis for building your retirement financial savings. As you investigate the assorted avenues for accumulating wealth, It can be necessary to align your alternatives with all your envisioned retirement age and desired Life style.

You will find that a perfectly-structured portfolio not simply grows your assets but will also mitigates challenges as your retirement age strategies.

You must recognize the importance of diversification. Spreading your investments across diverse asset classes—shares, bonds, housing, And maybe precious metals—will help regulate hazard and smoothens out returns over time.

It is also imperative that you reassess your hazard tolerance when you age; commonly, a shift in the direction of a lot more conservative investments is prudent while you close to retirement.

Tax factors play a basic job in maximizing your retirement financial savings. Reap the benefits of tax-deferred accounts like 401(k)s and IRAs, which permit your investments to expand without the drag of once-a-year taxes, and take into consideration Roth selections for tax-no cost withdrawals in retirement.

Remember, nevertheless, that unique procedures govern when and how one can access these money without having penalties.

A different important component is planning for the surprising. Insurance coverage items, including annuities and existence insurance plan, can offer added protection, guaranteeing that you will not outlive your personal savings or go away your dependents monetarily strained.

Last of all, it's necessary to overview and change your retirement strategy periodically, Specially just after key existence occasions or major market adjustments.

This adaptive solution not only safeguards your savings but also enhances your money resilience, making certain you happen read more to be well-organized for a comfortable retirement.

Helpful economical setting up hinges on the power to assess your present monetary standing, established real looking goals, and diligently deal with your budget and financial debt. Discovering various financial commitment possibilities and scheduling for retirement are important techniques toward securing your money upcoming. Consistently revisiting and modifying your financial plan ensures it remains aligned together with your evolving fiscal needs and plans. Embrace these procedures to navigate your money journey with self-confidence and precision.

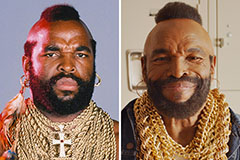

Mr. T Then & Now!

Mr. T Then & Now! Shaun Weiss Then & Now!

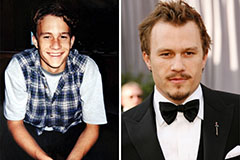

Shaun Weiss Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Traci Lords Then & Now!

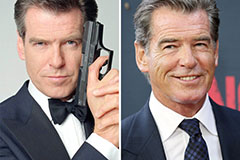

Traci Lords Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!